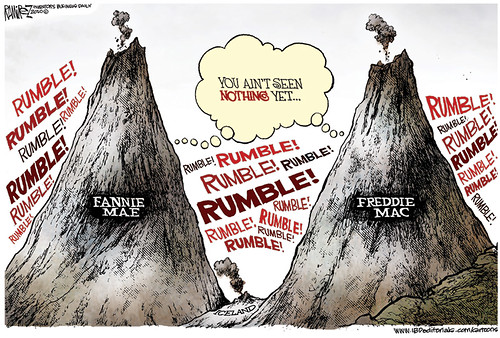

As recently as his State of the Union address this past January, President Obama wasreaffirming the support he announced last August for bipartisan plans making their way through both chambers of Congress to drastically reduce and/or eliminate the two lending giants’ outsized footprint in the housing market, pressuring lawmakers to “send me legislation that protects taxpayers from footing the bill for a housing crisis ever again, and keeps the dream of homeownership alive” by shifting the market more toward private lending. Opposition to the plan’s practical implications from some highly interested parties in the housing sector, as well as the upcoming midterm elections, have put Congress’s legislative role in the Fannie/Freddie drawdown in fuzzy and protracted territory — so in what will doubtless be the long interim before we see any major Congressional action on that front, the Obama administration is now planning to use their regulatory authority to… ramp up their role in the mortgage market and basically promote more risky lending? What? Via the NYT:

The federal overseer of Fannie Mae and Freddie Mac on Tuesdayannounced a shift in policies intended to maintain the mortgage finance giants’ role in parts of the housing market, spur more home lending and aid distressed homeowners.

“Our overriding objective is to ensure that there is broad liquidity in the housing finance market and to do so in a way that is safe and sound,” Melvin L. Watt, the new head of the Federal Housing Finance Agency, said in a speech at the Brookings Institution in Washington. …

Mr. Watt’s changes would perpetuate the presence of the two government-sponsored enterprises in mortgage finance, rather than shrinking it. …

Mr. Watt laid out several specific measures. For example, rather than reducing current limits on the size of the loans they guarantee, as previously proposed by the former overseer, Fannie and Freddie would keep the current, relatively loose, limits in place. The two enterprises back about two-thirds of all new mortgages.

The White House, via Jay Carney, applauded “the Federal Housing Finance Agency for issuing certainty and clarity on the rules of the road for loans backed by Fannie Mae and Freddie Mac” on Tuesday, and as Bloomberg notes:

Watt’s policy decisions will play an increasingly pivotal role in the nation’s housing finance system as bipartisan efforts to wind down Fannie Mae and Freddie Mac appear to be stalling in the Senate.

The Senate Banking Committee is expected to vote Thursday on a measure that would replace the two companies with a reinsurer of mortgage bonds that would suffer losses only after private capital was wiped out. The bill doesn’t have enough Democratic support to advance beyond the committee and legislative efforts to remake Fannie Mae and Freddie Mac are unlikely to continue before next year.

Well. So much for that, and in the meantime, it looks like the Obama administration just couldn’t resist the urge to keep getting the federal government increasingly involved in the economy.

Comments