“There are lies, damn lies, statistics . . . and then there are damnable statistical lies from politicians.”

Rajjpuut

“When you combine ignorance and borrowed money, the results can get interesting.”

Warren Buffet

Wide-spread Housing Collapse Underway

Main Obama Program Fails, ‘Cash for Keys’ Proposed

NOTE: CBS Moneywatch today, ran an article entitled “Why the Housing Market is three times worse than you think.” Since Rajjpuut has several times mentioned that when it comes to housing, the situation is probably seven or eight times worse than the administration wants people to believe, it’s time to clear the air. This blog concerns HAMP and other failed big government housing initiatives and how they’ve destroyed the U.S. housing market now and possibly well into the future. Many American readers know very little about the background of the situation which is provided in the next few paragraphs. If you’re well-informed, skip the introduction and head right down to the “red” paragraph below and start reading there . . . if you’ve foolishly been thinking over the years that politics and the economy don’t matter – don’t affect you, read and understand every word and continue to the footnotes and read and understand that as well. As the Kingston Trio once sang, “Citizens, hear me out, this could happen to you!”

As every would-be bride knows, it’s “something old, something new, something borrowed, something blue" . . . and yes, a similar pattern is starting to develop. The “old” is the outdated Keynesian idea that government can create real and meaningful jobs in free markets and that government interference could actually save free markets in times of duress; can improve the free market system.

The “new” under Obama was a series of handouts and bailouts bearing his signature ‘zero oversight, zero results’ label . . . first came the Obama $787 billion second-stimulus. Then “Cash for Clunkers” in mid-2009 proved itself an expensive program that accomplished little or nothing and absolutely destroyed the used car market so badly that’s its effects are still in place today: the average used car today costs $1,778 more than an average used car cost in 2009, hurting poorer Americans more than all others. Then came HomeStar, unofficially known as “Cash for Caulkers,” launched later that same year to encourage economic growth by offering incentives to homeowner and retailers and small business owners for improving their homes’ etc.’s energy efficiency. The program got all tied up in bureaucratic red tape when Republican oversight indicated that the beneficiaries would mostly tend to come from a narrow-range of construction firms that had contributed to the Obama presidential run in 2008. “Cash for Keys” (more below) is a similar program which has an importantly distinct “wrinkle.”

“Something borrowed” includes all the same lies that made Franklin Roosevelt (FDR) such a left-wing hero even though he took an ordinary recession and extended it out to 12.5 years until Pearl Harbor finally jump-started the economy and ended the country’s horrific malaise. In this age of real information available in real-time, however, the slick lies that allowed FDR to confiscate the nation’s gold coinage from citizens and then to re-peg the price of an ounce of gold from $20.76 up to $35 an ounce (a theft of the wealth of the citizens and an overnight inflation of roughly 69% which mugged 92% of all Americans <gold coin holders> on the one hand; and then impoverished 100% of the nation on the other) aren’t able to fester so long as there are now in the information age watchdogs like The Wall Street Journal and Fox News (and to a lesser extent USA Today) defying the liberal media’s cheerleading for the Obama administration and holding their feet to the fire every single day; 24 hours a day. Even though most citizens don't bother to educate themselves as to political reality; the 24-7 news cycle makes it impossible eventually for the majority to stay ignorant forever. When they "wise up" often their bitterness toward the liars in government can be dramatic: as we saw on the last Election Day.

Under real media scrutiny, Joe Biden’s remarkable rhetorical statement (“Are we going to have to borrow trillions, to keep from going bankrupt? Yes!”) was quickly revealed for the preposterous notion it was and not repeated. When a poll earlier this week showed that 60% of Americans do NOT approve of Obama’s economic programs and then virtually identical results came from the always trustworthy Rasmussen Reports, it shows that Americans sooner or later get the picture. Only 36% of Americans think the Obama economic programs are sound. 57% are so convinced that they're in favor of a government shutdown so long as substantial budget cuts result.

Something “blue” is the result of all the government interference in the once great American housing market. We’ll only touch briefly here on the well-documented fact that it was government interference** which created the crisis in the first place (see the footnote if you’ve been too busy watching sitcoms and IRreality shows to notice how the government stuck it to us . . . and pay attention from now on). We will mention that the job-killing government interference that supposedly was designed to expand job opportunities in the free market has had the exact opposite effect. The money that normally would sit on the sidelines during the initial stages of a recession and then come into play has stayed there on the sidelines for two and a half years now. The bottom of the recession, as shown by the American stock markets which usually get it close to right, was in mid-March, 2009 six months after the height of the financial crisis. Typically in normal times within another nine or ten months (that would mean at the end of 2009 or January of 2010) an all-out recovery is well underway.

However, thanks to all the new government regulation and interference and all the confusion and uncertainty that’s been created . . . even larger amounts of capital has stayed uninvested by small business, the engine of economic recovery. This is money that would have been working in the free markets for fourteen or fifteen months already which is too frightened by the economic assault Barack has lain upon them. Obamacare, is one of the administration’s worst moves ever. The new law all by itself created 384 new government agencies (in 12+ years FDR only created 39 new agencies) – no, that is NOT a typo, 384 new agencies and all their red tape anti-business bureaucracy Americans now have to deal with. Now let us move on to something’s “double-blue.”

On Tuesday, March 29th, the House of Representatives voted overwhelmingly to end HAMP one of president Obama’s most ambitious housing programs. HAMP (the Home Affordable Modification Program) was designed to keep homeowners in their homes despite being on the road to foreclosure for not paying their mortgages. Republicans and virtually all so-called “Blue-dog” Democrats agree nearly 100% that HAMP was a fiasco, a monumental failure. There are lies, damn lies, statistics . . . and then there are damnable statistical lies from politicians . . . such as when Janet Napolitano tells us with contrived data that the borders are safer than ever; or President Obama assures us that his approach to the housing approach is actually working quite well; and justifying his request to modify and expand the program . . . .

“Real” (meaningful numerical information designed to highlight a problem and point at a solution) statistics tell a different story than the Obama folk would have you believe. As soon as the repeal HAMP bill was passed in the House, fifty Democratic reps sent a message to Treasury Secretary Tim Geithner urging that he reform HAMP: “HAMP must change to meet its potential.” The real stats show a deeply flawed program. Besides the few Blue-dog Dems voting for the bill, most Democrats know that HAMP is the poster boy for failed government interference and government spending boondoggles, but they feel they must vote with their caucus and their president . . . so the HAMP repeal vote faces a highly uncertain future in the senate . . . not to mention that Barack Obama has said he will definitely veto the HAMP repeal bill should it reach the Oval Office. What is it about HAMP that Democrats find to love? First, the facts . . . .

The outgoing special investigator general for TARP (the Troubled Asset Relief Program), Neil Barofsky, called HAMP a "failure," in an interview with CNN on March 24th. He said HAMP was supposed to help 3 to 4 million underwater homeowners stay in their homes. But so far, it has only managed to help less than half a million do so despite immense expenditures of time and money. "It's really one of the deep failures of TARP," Barofsky said. "TARP wasn't supposed to just help the banks return to profitability, it was also supposed to help people stay in their homes." Mr. Geithner at the Treasury has pointed out, on several occasions, that while the HAMP program could be better, it's the only federal program spurring mortgage servicers to help homeowners.

What goes unmentioned among all the administration spin is that because of the huge amount of time and red-tape involved with HAMP and the refusal of many aggrieved foreclosed owners to leave their properties the possibility of a genuine recovery in the American housing market is years away. Until these depressed properties are handled, their shadow hangs over all potential dealings as the vast majority of Americans paying their mortgages every month find that their once “most valuable asset” (their home) has now become a monstrous drag on their personal finances. Should they want to sell, they face depressed prices and/or long periods of uncertainty before a buyer can be found. If they hold onto their homes they face 3%-10% drops in value that threaten in many cases to put them “underwater” on their mortgage despite their homes’ built-up equities.

Barack Obama’s refusal to insist that reasonable foreclosures be allowed to proceed is a huge black cloud hanging over the nation’s real estate marketing. Of course, Barack as an ACORN lawyer in the mid-90’s was helping shake down lenders and setting up a lot of these very same loans to ignorant and unworthy clients by extorting banks to abide with the federal government’s CRA ’77 legislation forcing them to make horrifically bad home loans so perhaps his judgment in the matter is clouded. Besides clearing this nebulous situation up, the Republican HAMP repeal bill will knock $1.3 billion off the federal deficits. So why does Obama and why do the progressives Democrats love HAMP? Despite all their claims about Bush and “the car in the ditch,” most Democrats know who really caused the financial meltdown we saw beginning in late 2007. They’d prefer, however, to continue to lie to themselves and to the American voter.

HAMP is their last ditch effort to prove to themselves that despite the obvious facts on display . . . government interference works; that they really did NOT undermine and cut the legs off the U.S. economy with all their constant mortgage industry interference beginning with CRA ’77 (see the earlier mentioned footnote** below). Of course the fact that the original CRA President was Jimmy Carter; and our first ACORN president Bill Clinton, expanded Community Reinvestment ACT ‘77 legislation once by regulatory fiat in 1993; twice by separate legislations in 1995; and by a steroid-version expansion of the law in 1998; and the fact that Barack Obama was an ACORN lawyer for parts of three years shaking down banks and mortgage companies to extort their involvement in CRA 77 and grant knowingly unsound loans to knowingly terribly fiscally-unworthy clients . . . these facts should not color your evaluation of progressive politicians and their competence now, should it?

So what is the big picture here? What’s going on in the housing markets? When can we expect a full recovery? Recent reports show that new home sales hit a record low in February, 2011. Last week we found out that 19 of the 20 largest metros areas according to Standard and Poors, experienced a pricing slump in January. This is horrible news three years into the financial meltdown and almost by itself guarantees a “double-dip” recession. Ah, but the situation degenerates even more . . . .

The good news is that besides some job growth and a tiny wage growth . . . American banks are finally looking at the economy with a rosier perspective and are now far more likely to grant home loans. However, the fly-in-the-ointment is the nasty situation with depressed and foreclosed homes mentioned above. It’s what the mortgage industry calls “shadow inventory.” Besides the alarming backlog of older homes on the market and the relative DEPRESSION in new home turnover, there is this nagging shadow inventory that can’t be dealt with properly because of the government red tape; Obama’s intransigent belief that his programs are infallible; and Eric Holder’s “INJUSTICE DEPARTMENT” standing in the way, protecting the unworthy ACORN-inspired borrowers over the forced-to-loan-‘em-money-by-your-stupid-CRA ’77-law banks and handcuffing the entire U.S. economy as a result.

Here’s what the statistics tell us: A) 3.5 million existing homes are being tracked by the National Association of Realtors (NAR) which, at their current prices, are homes that would sell on average only after 8.5 – 9 full months’ exposure on the market. B) The “shadow inventory” that the government and the banking industry would like to pretend isn’t fouling their nets is, if you press them, another 1.8 million homes definitely likely to hit the market sometime soon in our futures. Why? Some people will eventually “just walk away” from their underwater mortgages; or from their job losses which have made them unable to continue paying on older homes in which they’ve some real equity; most of these people are now anywhere from three months to nine months behind in paying their mortgages and foreclosure is now a definite prospect. And what is the likely result of all this shadow inventory eventually? A large chunk of these homes will appear on the market and the NAR’s projected nine month turnaround will then jump to an average of two years . . . a literal disaster for home-sellers and C) in reality the biggest lie of our time concerning the mortgage industry is now coming to light: it appears that a hither-to unreported severely underwater shadow inventory has been glossed over until now.

These are two million homeowners who now find themselves at least 50 percent underwater on their mortgages. A huge percentage of these folk were the “beneficiaries” of the CRA ’77 legislation and ACORN’s efforts to put the jobless and poor credit risks and even illegal aliens into expensive homes (that statement is zero exaggeration, but LITERALLY 100% true). A leftist rebellion has charged many of these folks with a zeal for ignoring the facts of life and staying in their homes (despite years of not paying their mortgages in many cases) despite the official proceedings. To say that this element is a severe drag on the housing market is to underestimate reality by 600% in Rajjpuut’s opinion. IF they are allowed to get away with this the banks are really in trouble. IF they get away with this, what’s also to stop normal, honest debtors who can afford their mortgages but who find themselves underwater from saying “Screw it? I like their idea!” What would prevent that? This sort of widespread collapse of private property would mean the end of America as we know it.

Rather than facing reality, the Obama administration is looking at creating another government-spending and government-interference boondoggle called “Cash for Keys.” Their idea is to give $21,000 to all the bad loan recipients from CRA ’77 so they’ll vacate their homes and the housing market can finally start to return to normalcy. So the progressives in the federal government almost bankrupted the banks and mortgage companies by forcing them to make horrifically bad loans to those people (many of whom could not honestly afford an $800 used car) and after bailing out the banks, they’re going to bailout these fools who couldn’t figure that there was no way in hell they could ever pay off their home loans . . . . Now do you still believe in making government bigger? What do you think of government-forced redistribution of wealth schemes now?

For the home-sellers in the worst-hit states: (New Jersey, Illinois, Maryland, Florida, Delaware, Georgia, Connecticut, Alabama, California and Washington) those turnover numbers are beginning to drag out already. Only four states seem to have a semi-healthy housing industry outlook for 2011-2012: the aforementioned North Dakota, Alaska, Wyoming and Montana. Sugar-coating all this information is the Obama strategy to get him through the next nineteen months and re-elected . . . excess sugar is terrible for your health.

As a quick side note: if you’re in the market for a home, present mortgage rates are very much on your side, so take your time, look over the available housing carefully; don’t be afraid to offer 50%-60% of asking price. After initial refusal you might find a bargain home in five or six weeks. If you’re selling a home, make sure you live in North Dakota, Alaska, Wyoming or Montana; or look to hold onto it for 8-10 years when the markets might hopefully rebound and stabilize at a higher level. Of course, if we wind up with hyper-inflation in the next decade, your home and its present ridiculously high mortgage might just prove to be your saving grace if you can survive the ravages of 80% or higher inflation. Good luck, America!

Ya’all live long, strong and ornery,

Rajjpuut

** “When you combine ignorance and borrowed money, the results can get interesting.” Warren Buffet Buffet’s comment not only applies to the unworthy and ignorant borrowers (perhaps worthy of a 55% down payment loan for an inexpensive home if they won a lesser part of the lottery some day, but definitely NOT worthy of a 0.0% loan on a $400,000 home) blogged about here . . . but also to the ignorant and heavily mortgaged Federal Government. Are you far better off now, than you were $5 TRillion ago? I’m not and neither is the country. How did we get into this mess? It’s a long but very interesting story . . . .

ITEM: In 1975, 64% of American private citizens owned their own homes, then the highest in the world. Only one loan in 404 was considered “suspect.” 90% of home loans were granted with 20% to 33% down payment. Even the “suspect” loans were special cases, typically military officers attending college on the GI bill who received mortgages in some cases with 3% down payment. In short our private home ownership mortgage system was NOT broken. But progressive politicians of both parties would soon fix that, and us.

A decade earlier, a progressive president, Lyndon Baines Johnson, not only got us deeply involved in war in South East Asia, but also launched an expensive “War on Poverty” which included Medicare and the Federal side of Medicaid that today face a combined $68 TRillion in unfunded liabilities; a broad expansion of Social Security benefits (now with $36 TRillion in unfunded liabilities); and a sweeping and, of course, overly generous and anti-work-incentivized welfare set of expansions. About the time this was happening, a husband and wife neo-Marxist team, Richard Andrew Cloward and Frances Fox Piven, published an article in The Nation magazine in 1966 entitled The Weight of the Poor: a Strategy to End Poverty which has come to be popularly known as the “Cloward-Piven Strategy;” the two were Columbia University professors not opposed to crapping in their own nest (New York City) as you’ll soon see. In C-P Strategy the poor are unwittingly used as leftist storm troopers in their attempt to bankrupt the federal government of the United States.

Their stated goal -- when they established the National Welfare Rights Organization (NWRO) in 1967 with Black militant activist George Wiley – was to bankrupt the welfare system by creating a huge welfare state and thus to cause such financial chaos they’d get the Democratic Party to institute a Guaranteed National Income (GNI). This approach they said would SNAP! eliminate poverty; totally destabilize American capitalism; and set the country on the fast lane to “the Revolution.” Frances Piven, by the way, is still alive and still calling for “The Revolution” and violence and blood in the streets today. Rajjpuut bets “Nana Frannie” makes a wonderful peachy-keen grandmother – wanna bet she knits some wonderful Afghans?

Their Alinsky street-battling worked wonders in the welfare offices (self-proclaimed “neo-Marxist Saul Alinsky is famous for Reveille for Radicals in 1946; and Rules for Radical in 1971 he also was a mentor to Hillary Clinton and his “Rules for Radicals” course was taught in Chicago by Professor Barack Obama) and C-P strategy worked “wonderfully,” welfare rolls were doubled within three and a half years and by 1975, New York City was bankrupt; New York State itself was on the verge of bankruptcy and numerous large metropolitan areas and big-city states around the country were also in dire fiscal straits. NYC was bailed out by the federal government in November that year.

Wiley and Cloward and Piven took to publically boasting of the “great things they’d accomplished” even though their stated goal (GNI) was never an idea discussed seriously in Congress;” then they called upon their followers (using the “Saul Alinsky street tactics” Wiley had perfected for future endeavors) to now get involved in federal housing and in voter registration. Therein hangs the meat of our tale . . . .

ITEM: As new president Jimmy Carter took office in January, 1977, a Wiley-NWRO lieutenant sent to Arkansas about 1970, Wade Rathke, was assigned the task of coming up with a Cloward and Piven type organization along the lines of the NWRO to test out in Arkansas. Arkansas was chosen because it was far from the “media glare” and because they had an up-and-coming young politician whose thinking ran to progressive aims that C and P and Wiley strongly believed in: Bill Clinton, at 30 years old one of the youngest Lieutenant Governors in the country and one of the nation’s most promising Democrats.

The stimulus for the Rathke assignment was that Carter and the Democrats had promised CRA ’77- (Community Reinvestment Act of 1977) type legislation designed to spread the wealth by forcing mortgage companies to make home loans to bad risk clients (at that time just in the inner cities) who, as they saw it, might otherwise not be in the housing market for ten or twelve years. Perhaps 4% of Americans understand the whole big picture of Cloward and Piven and of Carter’s CRA ’77 legislation and how it led inexorably to the financial meltdown of 2007. It’s a fascinating story. But first consider this: it took Cloward and Piven’s NWRO parts of eight years to bankrupt NYC and nearly bankrupt New York State and with Bill Clinton’s unending support, it took ACORN roughly 30 years to bring down the USA and almost ruin it irreparably.

ACORN (originally the Arkansas Community Organizations for Reform Now) was created at virtually the same moment as Carter’s CRA ’77 law was signed. At first ACORN was largely ineffective in getting housing action but they went out almost immediately and began registering voters for the 1978 Arkansas election. They signed an enormous bunch of people up; many of them were even real people really eligible to vote in Arkansas. They also threw all the Republican registrants paperwork in the trash which threw the 1978 election dramatically to William Jefferson Clinton, the state’s new governor. At that time Arkansas governors were only elected to two-year terms, later that changed. Nevertheless with ACORN’s backing Bill Clinton remained Arkansas governor for 12 of the next 14 years and became president of the United States in 1992. Meanwhile ACORN had figured out how to get lots of bad home loans for risky clients. In a little while, ACORN was found in all 50 states and now stood for: Association of Community Organizations for Reform Now. By 1985, the action of ACORN limited only to Arkansas had made a big difference in overall mortgages in the entire United States. The number of suspect loans was roughly doubled: from 1 in every 404 in 1975, to 1 in 196 by 1985.

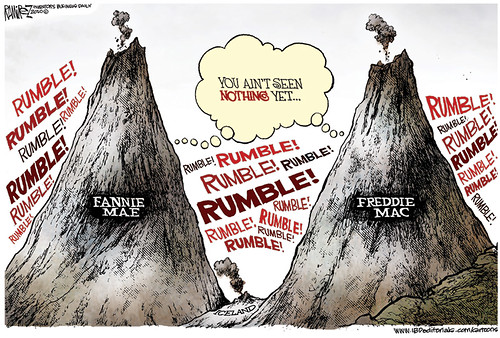

ITEM: The election of Bill Clinton in 1992 was a welcome relief for progressives after the fiasco that was Jimmy Carter in 1980; and the non-electables Walter Mondale in 1984 and Michael Dukakis in 1988. Even though Clinton made the CRA ’77 situation much worse, it would be unfair to give Democrats all the blame. About 80% of Democrats were progressives in the early 1990’s but progressive Republicans played a role every step of the way and, even a non-vigilant conservative president caused us a lot of problems. George H. W. Bush who succeeded in upholding 45 out of 46 presidential vetoes against a big-spending congress saw a bill pass his desk that he approved of except for two or three small details. Instead of standing his ground, Bush #1 signed the bill into law instead of vetoing it and sending it back to Congress for removal of the offending parts. Too bad, part of that bill was an expansion of CRA mortgage legislation into the big federal mortgage programs Fanny Mae and Freddy Mac -- a huge mistake. The good thing was that the original CRA ’77 was a poorly constructed law that mostly any conscientious mortgage company could largely ignore.

Bill Clinton came into office in January, 1993 aiming to put across a very ambitious conservative agenda including government health care. He was beholden to ACORN and to all the Cloward-Piven people and more importantly he largely believed as they did. His first two major actions were aimed at re-paying them. You’ll recall that ACORN was created in response to the C-P call for their supporters to get involved in voter registration and in federal housing after their success in bankrupting NYC . . . Clinton passed the “Motor Voter Act” called by opponents “a twelve-lane highway to voter fraud.” No doubt the ACORN people considered Motor Voter to be a great help to their registrations scams. If you’ll visit this picture of the Motor Voter signing ceremony you’ll see something very important in the picture:

Yes, if you visited the Wikipedia link given earlier you’re right, that is Frances Fox Piven in the green sweater standing almost directly behind President Clinton with her husband Richard Cloward the tall man with glasses to her immediate left watching the Motor Voter Act get signed into law.

Clinton also used the regulatory fiat of his office to turn the rather cumbersome CRA ’77 legislation into a powerful and more easily enforceable law. Now it would not be so easy for mortgage lenders to laugh off the notion of making bad loans to unqualified would-be home buyers . . . now it would become part of their everyday life. Twice in the year 1995, Clinton was able to sneak bills further expanding CRA ’77 through Congress even though it was dominated by Republican majorities in the House and Senate. Newt Gingrich the Speaker of the House did a horrible job and allowed almost anything the Democrats could dream of into numerous “compromise bills.” During this time a Chicago attorney named Barack Obama was working for ACORN and shaking down home loan companies. Obama was reputed to be so good at his job that court appearances never happened. The Banks just caved in, agreed to a certain pattern of loans and usually even offered up a donation to ACORN thanks to Barack’s persuasiveness. By 1995, one in every seven home loans was suspect and also offered at less than 3% down payment.

Finally, in 1998 Clinton passed the steroid version of CRA ’77 in 1998. Obama was long gone but the ’98 Clinton expansion of CRA put ACORN in the driver seat. From now on they’d have less trouble getting unqualified loan recipients into $440,000 homes than they had getting them into $110,000 homes a decade earlier. ACORN had elevated its shake-down processes into a science. Where before loans for moderately bad risks had been common, the new law made it easy for ACORN to get home loans for people without jobs; people with bad credit ratings; people without even rental histories; people whose only “income” was food stamps; or other welfare roll recipients; and even illegal aliens. By 2005, 1 in every 3 home loans (34% to be precise) was granted to unqualified loan recipients at 3% down payment or less . . . many of them at 0% down. The housing bubble was accelerating and America was in trouble.

Perhaps the first person to write about the seriousness of the bubble was investech.com guru James Stack out of Whitefish, Montana. As early as late November, 2003, Stack was upon the problem like ugly on an ape. He soon began including a graph of the Housing Industry bubble which he said had been created by senseless sub-prime loans that could never be expected to be repaid. That graph slowly changing month after month was a regular part of the investech weekly reports for roughly the next 5 ½ years. The Republicans of the Bush #2 administration figured things out by late December, 2004 and presented Congress with a bill undoing the 1998 Clinton expansion and many of the most harmful features of all the CRA ’77 legislation. President Bush gave nineteen separate speeches about the unraveling of the American economy that CRA ’77 was bringing about. The bill was defeated every time and the liberal press virtually totally ignored the story. Rajjpuut, who had been warning people since December, 2003 was aghast. Here was the most serious financial debacle of our time and no one cared.

Finally, 30 months after their first try, the Republicans passed a seriously watered-down version of the anti-CRA ’77 bill in July, 2007 just about the time the problem became Unignorable. It was, of course too little, too late. Nevertheless, according to a speech Treasury Secretary Timothy Geithner made in August, 2010, Bush’s efforts probably saved the nation from absolute financial Armageddon and he credits Bush in particular for preventing a total meltdown in housing prices. So as far as that little fable Mr. Obama delights in about the Republicans, conservatives and Wall Street driving the economy in the ditch . . . the truth is quite different. Here it is:

George W. Bush seeing the progressives, Bill Clinton, Barack Obama and most Democrats deliberately pushing the car (the economy) toward a 500 foot-cliff, jumped into the front seat grabbed the steering wheel and hit the brakes and guided it into the nearest friendly-looking ditch. Amen.

It's that key word "deliberately" that is most disturbing on two levels: first, that one of our major parties has been hijacked by people (progressives) who put their own agenda totally and utterly ahead of the nation's because they know best for all of us; and secondly, the fact that only two main news sources in the country have considered this story important enough to cover. Just in case you don't know what progressivism is: it's the conviction that we must "progress" beyond the 'outdated and ill-conceived U.S. Constitution' if we are to make necessary "progress" toward an earthly Utopia.