Primary election tomorrow in NY State, does anyone know who the Tea party is supporting.

Please reply,

Don S

Primary election tomorrow in NY State, does anyone know who the Tea party is supporting.

Please reply,

Don S

The article below was written by Gary Hubbell, a rancher, fishing guide and real estate agent, in Aspen Colorado of all places....Someone picked this up and began circulating it. To confirm its authenticity, someone emailed Gary and received the following reply:

Yes, indeed, I did write that. Thanks for your compliments.

Regards,

Gary Hubbell, Broker/Owner

United Country Colorado Brokers

Hotchkiss, CO 81419

EXCELLENT ARTICLE. NEVER EVER WOULD I HAVE THOUGHT THIS WOULD COME OUT OF ASPEN ,

http://www/.aspentimes .com/article/20100228/ASPENWEEKLY/100229854/

Barack Obama has awakened a sleeping nation

Gary Hubbell

Aspen Times Weekly February 2010

Barack Obama is the best thing that has happened to America in the last 100 years. Truly, he is the savior of America 's future.

Despite the fact that he has some of the lowest approval ratings among recent presidents, history will see Barack Obama as the source of America 's resurrection. Barack Obama has plunged the country into levels of debt that we could not have previously imagined; his efforts to nationalize health care have been met with fierce resistance nationwide; TARP bailouts and stimulus spending have shown little positive effect on the national economy; unemployment is unacceptably high and looks to remain that way for most of a decade; legacy entitlement programs have ballooned to unsustainable levels, and there is a seething anger in the populace.

That's why Barack Obama is such a good thing for America . Here's why.

Obama is the symbol of a creeping liberalism that has infected our society like a cancer for the last 100 years. Just as Hitler is the face of fascism, Obama will go down in history as the face of unchecked liberalism. The cancer metastasized to the point where it could no longer be ignored.

Average Americans who have quietly gone about their lives, earning a paycheck, contributing to their favorite charities, going to high school football games on Friday night, spending their weekends at the beach or on hunting trips - they've gotten off the fence. They've woken up. There is a level of political activism in this country that we haven't seen since the American Revolution, and Barack Obama has been the catalyst that has sparked a restructuring of the American political and social consciousness.

Think of the crap we've slowly learned to tolerate over the past 50 years as liberalism sought to re-structure the America that was the symbol of freedom and liberty to all the people of the world. Immigration laws were ignored on the basis of compassion. Welfare policies encouraged irresponsibility, the fracturing of families, and a cycle of generations of dependency. Debt was regarded as a tonic to lubricate the economy. Our children left school having been taught that they are exceptional and special, while great numbers of them cannot perform basic functions of mathematics and literacy. Legislators decided that people could not be trusted to defend their own homes, and stripped citizens of their rights to own firearms. Productive members of society have been penalized with a heavy burden of taxes in order to support legions of do-nothings who loll around, reveling in their addictions, obesity, indolence, ignorance and "disabilities." Criminals have been arrested and re-arrested, coddled and set free to pillage the citizenry yet again. Lawyers routinely extort fortunes from doctors, contractors and business people with dubious torts.

We slowly learned to tolerate these outrages, shaking our heads in disbelief, and we went on with our lives.

But Barack Obama has ripped the lid off a seething cauldron of dissatisfaction and unrest.

A former Communist is given a paid government position in the White House as an advisor to the president. Auto companies are taken over by the government, and the auto workers' union - whose contracts are completely insupportable in any economic sense - is rewarded with a stake in the company. Government bails out Wall Street investment bankers and insurance companies, who pay their executives outrageous bonuses as thanks for the public support. Terrorists are read their Miranda rights and given free lawyers. And, despite overwhelming public disapproval, Barack Obama has pushed forward with a health care plan that would re-structure one-sixth of the American economy.

Literally millions of Americans have had enough. They're organizing, they're studying the Constitution and the Federalist Papers, they're reading history and case law, they're showing up at rallies and meetings, and a slew of conservative candidates are throwing their hats into the ring. Is there a revolution brewing? Yes, in the sense that there is a keen awareness that our priorities and sensibilities must be radically re-structured. Will it be a violent revolution? No. It will be done through the interpretation of the original document that has guided us for 220 "FANTASTIC" years--- the Constitution. Just as the pendulum swung to embrace political correctness and liberalism, there will be a backlash, a complete repudiation of a hundred years of nonsense. A hundred years from now, history will perceive the year 2010 as the time when America got back on the right track. And for that, we can thank Barack Hussein Obama.

Gary Hubbell is a hunter, rancher, and former hunting and fly-fishing guide. Gary works as a Colorado ranch real estate broker. He can be reached through his website,aspenranchrealestate.com

IF YOU AGREE, SHARE THIS . IF YOU DON'T, DO NOTHING AND KEEP YOUR HEAD IN THE SAND.

At the 9-11 Memorial, Obama read Psalm 46. Bush read one of Lincoln’s letters. Biden attacked the “galvanized new generation of patriots.” AFL-CIO chief Trumka accused everyone in America who did not agree with him of being hate mongers—against union members’ pay, their pensions, their jobs. Trumka’s answer: everyone should have a high paying job and pension.

President Obama, supporter of big labor, who vowed to transform America, the President who built America’s national debt more than all the other presidents put together, who caused America to lose her highest credit rating, the President who is bankrupting America morally, spiritually, and fiscally, reads scriptures and tacitly agrees with Biden and Trumka. And Biden and Trumka vilify the American people. Nice work if you can get it.

On September 17, I will be 86 years-old. I would not have believed this had I not witnessed it. As for me, these are the best years of my life. All of my dreams have come true, unfortunately, at the great cost of America. All credit goes to government. America’s government gave the American people what they asked for. Trumka has the answer: see that everyone has a good job and a pension. Stop listening to America’s hate mongers. Don’t change.

Anyone surprised?

Posted on Canada Free Press-By Dr. Laurie Roth-On September 8, 2011:

“Clarity, evidence and knowledge apparently mean nothing to most of our media, political leaders and elite. Most already know, from entry level to the big boys, we all listen to and watch, that Obama is not Constitutionally eligible to be President.

Most also know by now that on April 27th, 2011, Obama presented a proven forgery of a long form birth certificate to the media and nation. Doug Vogt, a 29-year veteran, document examiner analyzed the presented document Obama showed thoroughly. He quickly signed an affidavit declaring it a total fraud and forgery and registered a 25-page complaint with the FBI. Last I checked, showing a forgery to the public and using false documentation is a felony. Gee, does anyone see a little problem here???

Our President has spent nearly 2 million dollars hiding documents about his passport, College records and Birth certificate obamacrimes.com. In a fabulous article on this critical violation, Lawrence Sellin reminds us also about other Obama breaches and controversies such as his Selective Service registration and using a Social SecurityNumber not issued to him.

Most in our media and the wanna be GOP messiahs call the eligibility folks names, “waste of time” “we have bigger fish to fry” and “we are annoying.” While the bloodletting continues, we have a usurper in the White House who has committed a federal crime on April 27th by showing a forged birth certificate. Obama has revealed his original intent in his own books and well before he was elected President. He is a redistribution of wealth, Marxist/communist.

Obama’s intent is quite clear by his words, actions, history and associations. He wants two classes of people, the international ruling class, headed by him, and the worker bee surfs who obey. To create a devoted sea of surfs, he must throw his followers enough bones that they think he is their savior and messiah. He must also seduce them into the fabricated ‘cause.’ This means giving up their money and assets to the Government so they can allegedly fix the desperate problems that Obama’s regime has created in the first place.

While the frustration and anger builds with ‘the people’ due to unemployment, financial ruin and endless foreclosures, rage is trained to focus on a new list of enemies, the Tea Party, congress and conservative groups. The goal is to create enough chaos, diversions and enemies that America crumbles economically, religiously, financially and politically.

Don’t you find it amazing how several Representatives, Vice President Biden and Obama have called the Tea Party every name in the book. You know, they want black people to hang from trees, are terrorists, racists, anti American and hostage takers. I guess these sorry freaks can ‘go straight to hell.’ That about covers it. The hope is that we all start viewing patriot groups and Tea Party folks as those wanting to create race wars and hurt our country. Evil, I tell you. The truth is exactly the opposite. They represent a broad tapestry of America, Black, White, Hispanic, Republican, Democrat, Independent and represent many religions. They have never been about destroying our Government and country. Instead they are protective of freedom, our constitution, common sense values and accountability, all of which are the enemies to Obama and his minions.

The battle lines have been drawn and the revolution is on. Don’t back down. Don’t believe the lies and vote Obama out of the White House in 2012. Finally, listen in each day therothshow.com and join the Roth Revolution and make your voice heard.”

Source:

http://canadafreepress.com/index.php/article/40164

Note: The following articles and/or blog posts relate to this disturbing issue-You Decide:

I. Many Voters Still Think Obama Wasn't Born In USA! Birth Certificate A Forgery?

No surprise here!

Posted on News, Interviews and More-By Robert Paul Reyes-On September 6, 2011:

“A new poll of Republican voters in the early primary state of South Carolina suggests the question of Barack Obama‘s eligibility is no fringe issue, as 65 percent of those polled question whether the current occupant of the Oval Office was even born in the U.S.

The automated telephone survey of 750 usual South Carolina Republican primary voters was conducted by the Democratic polling company,PublicPolicyPolling, from Aug. 25-28.

According to PPP‘s published results, when asked, “Do you think Barack Obama was born in the United States?” 44 percent answered ‘no‘ and an additional 21 percent answered ‘unsure‘ “ a total of 65 percent questioning his birthplace “ leaving only 35 percent who answered definitively ‘yes.‘”

Drew Zahn/WND

The results of this survey are shocking and they don‘t bode well for President Obama‘s chances of winning re-election.

The economy doesn‘t show any signs of significantly improving before the 2012 election. Obama can‘t run on his accomplishments on the home front, he inherited a bad economy and succeeded only in making it worse.

This time around Obama can‘t blame Bush for all of the nation‘s woes. The dreadful economy is an albatross around his neck, he owns it lock, stock and barrel.

Obama can run only on his character and moral authority, but the results of this poll indicate that most Republicans don‘t trust him. Obama will need the votes of Republicans and Independents to win re-election.

There are still many doubts about the legitimacy of the Obama administration. Why did Obama spend millions to keep his long-form birth certificate from seeing the light of day? Why didn‘t Obama make his original long-form birth certificate available to experts? Why did he release only a computer generated copy, instead of the actual birth certificate? Why hasn‘t Obama released his medical records? Why hasn‘t he released the transcripts from the prestigious universities he attended?

Obama is a mystery wrapped in an enigma and enveloped in arrogance.

There are many questions that haven‘t been answered about Obama‘s biography—this liberal may sit out the 2012 presidential campaign.”

Source:

II. How does Obama's document stack up against genuine BC? ‘Volunteer produces Kapiolani form from same time period as president's’-Posted on WND.com-By Jerome R. Corsi-On September 11, 2011:

http://www.wnd.com/?pageId=342937

III. Colin Powell responds to Birther Summit by covering for Obama!-Posted on SonoranNews.com-By Linda Bentley-On September 7, 2011:

http://www.sonorannews.com/archives/2011/110907/frontpage-Powell.html

IV. Jerome Corsi on WABC Radio: Obama’s Forged Birth Certificate & Tax Fraud!-Posted on United States Justice Foundation-On September 6, 2011:

http://usjf.net/2011/09/jerome-corsi-on-wabc-radio-obamas-forged-birth-certificate-tax-fraud/

V. White House Links to Deliberate Forgery From Snopes.com, Thinking it Was Real!-Posted on WND.com-By Jerome R. Corsi-On August 9, 2011:

http://www.wnd.com/?pageId=331525

VI. Alias Barack Obama: The Greatest Identity Fraud In History!-By Dr. Ronald J. Polland, PhD.:

VII. Washington Times Columnist to Obama: Resign!-Posted on Floyd Reports-By Ben Johnson-On August 12, 2011:

http://floydreports.com/washington-times-columnist-to-obama-resign/

Note: My following blog posts contain numerous articles and/or blog posts and videos that relate to this disturbing issue-You Decide:

Could the President’s newly released COLB be a forgery?

http://weroinnm.wordpress.com/2011/04/29/could-the-president’s-newly-released-colb-be-a-forgery/

The Greatest Fraud Perpetrated in American History!

http://weroinnm.wordpress.com/2011/06/20/the-greatest-fraud-perpetrated-in-american-history/

Congress report concedes Obama eligibility unvetted!

http://weroinnm.wordpress.com/2010/11/09/congress-report-concedes-obama-eligibility-unvetted/

DC knows that Obama is ineligible for office!

http://weroinnm.wordpress.com/2010/04/27/dc-knows-that-obama-is-ineligible-for-office/

Is History Repeating Itself?

http://weroinnm.wordpress.com/2010/09/20/is-history-repeating-itself/Washington Times Calls for Obama’s Impeachment!

http://weroinnm.wordpress.com/2010/08/31/washington-times-calls-for-obama’s-impeachment/

Is it important to understand the Marxist assault on the foundations of our system?

Note: If you have a problem viewing any of the listed blog posts please copy web site and paste it on your browser. Be aware that some of the articles and/or blog posts or videos listed within the contents of the above blog post(s) may have been removed by this administration because they may have considered them to be too controversial. Sure seems like any subject matter that may shed some negative light on this administration is being censored-What happened to free speech?-You Decide.

“Food For Thought”

God Bless the U.S.A.!

https://www.youtube.com/watch?v=Q65KZIqay4E&feature=related

Semper Fi!

Jake

Obama Tries To Explain What Went Wrong With Promised Freebies But It's Just Not Quite Sinking In With Fans. Obama products that will make you laugh.Welcome to American Patriots!

Anyone surprised?

Posted on WND.com-By Aaron Klein-On September 8, 2011:

“TEL AVIV – The Democrat strategist identified as an architect of the social protests currently rocking Israel previously ran the campaign of Bolivia’s former president, who was ushered into office amid escalating social protests in that country.

After Gonzalo Sánchez de Lozada took power in Bolivia in 1985, he quickly implemented an economic “shock therapy” crafted by Jeffrey Sachs, a Columbia University professor who sits on the board of an organization literally seeking to reorganize the entire global economic system.

That group is the Institute for New Economic Thinking, or INET.

Find out here what Americans need to accomplish to restore their nation to greatness.

Philanthropist George Soros is INET’s founding sponsor, with the billionaire having provided a reported $25 million over five years to support INET activities.

Last weekend saw the largest protests in Israel’s history. Four hundred thousand people hit the streets in cities across the country purportedly to protest against the rising cost of living while demanding sweeping economic reforms.

That massive protest was the culmination of weeks of similar social demonstrations and protest tent cities that organized in various Israeli municipalities, principally in Tel Aviv.

WND has reported how similar tent cities are being planned by a slew of U.S. radicals calling for a “Day of Rage” targeting Wall Street and U.S. capitalism.

'Our brand is crisis':

According to an investigative report in Israel’s Maariv’s newspaper, the country’s protests were engineered by a group of media strategists directed by prominent Democratic strategist Stanley Greenberg, a former adviser to Bill Clinton, John Kerry and others.

Greenberg reportedly is working with Israeli strategists who were behind left-wing leader Ehud Barak’s successful race for prime minister in 1999. Greenberg himself helped to run Barak’s campaign.

Greenberg founded the Democratic strategy firm Democracy Corps with Clinton advisers James Carville and Bob Shrum. Earlier, the trio ran a strategizing outfit called Greenberg Carville Shrum.

That firm in 2002 was behind a sophisticated campaign in Bolivia that helped de Lozada win his country’s elections amid ongoing social protests. It was the second time de Lozada served as Bolivia’s president.

In 1985, after de Lozada came to office the first time, he quickly implemented Sachs’ “shock therapy.” De Lozada attempted to engineer the restructuring of the Bolivian economy and the dismantling of the country’s state-capitalist model that had prevailed there since the 1952 Bolivian Revolution.

Sachs is a renowned international economist best known for his work as an economic adviser to governments in Latin America, Eastern Europe, and the former Soviet Union

His “shock therapy” calls for drastically cutting inflation by scrapping all subsidies, price controls, restrictions on exports, imports and private business activity. The scheme also calls for linking each restructured country’s economy with a more global currency.

Sachs’ remedy for Bolivia, however, had dire consequences.

The Sachs plan did beat the country’s inflation, but the price was continuing high unemployment, economic stagnation, labor revolt, a state of siege and a deepening involvement in the international drug market, reports noted.

To beat the hyperinflation under Sachs’ plan, Bolivia ensured a large number of workers were laid off while others’ salaries were slashed, leading to widespread worker strikes.

The Bolivian government imposed a state of siege in response to a wave of strikes.

Similar protests engulfed Bolivia when Greenberg’s firm helped to orchestrate de Lozada’s 2002 win. De Lozada had announced that he planned to once again implement Sachs’ “shock therapy” for Bolivia.

A 2005 documentary, entitled, “Our Brand is Crisis: Exporting neoliberal spin,” followed Greenberg’s and Carville’s electioneering in Bolivia on behalf of de Lozada.

The film noted Greenberg’s team saw no need to recraft de Lozada’s economic policy approach based on Sachs “shock therapy” plan.

De Lozada was victorious in the 2002 elections, but was run out of office one year later amid massive opposition to his economic policies. Protesters demanded a return to the capitalist system.

Bretton Woods and 'shocking' world economy:

Sachs, meanwhile, sits on the board of the Soros-funded Institute for New Economic Thinking.

This past April, Sachs keynoted INET’s annual meeting, which took place in the mountains of Bretton Woods, N.H.

The gathering took place at Mount Washington Hotel, famous for hosting the original Bretton Woods economic agreements drafted in 1944. That conference’s goal was to rebuild a post-World War II international monetary system. The April gathering had a similar stated goal – a global economic restructuring.

A Business Insider report on last year’s event related, “George Soros has brought together a crack team of the world’s top economists and financial thinkers.”

“Its aim,” continued the business newspaper, “to remake the world’s economy as they see fit.”

More than two-thirds of the speakers at this year’s conference had direct ties to Soros.

Besides his role at INET, Sachs, a special adviser to U.N. Secretary-General Ban Ki-moon, is founder and co-president of the Soros-funded Millennium Promise Alliance, a nonprofit organization that says it is dedicated to ending extreme poverty and hunger.

Global taxes:

With $50 million in capital from Soros, Millennium promotes a global economy while urging cooperation andinvestment from international banks and the United Nations Development Program.

The group helped to found the United Nations Millennium Development Goal, a move that was advanced by Sachs. He served as director from 2002 to 2006.

The U.N. Millennium Development Goal has demanded the imposition of international taxes as part of a stated effort of “eradicating extreme poverty, reducing child mortality rates, fighting disease epidemics such as AIDS, and developing a global partnership for development.”

Investor’s Business Daily reported the Millennium goal called for a “currency transfer tax,” a “tax on the rental value of land and natural resources,” a “royalty on worldwide fossil energy projection – oil, natural gas, coal,” “fees for the commercial use of the oceans, fees for airplane use of the skies, fees for use of the electromagnetic spectrum, fees onforeign exchange transactions, and a tax on the carbon content of fuels.”

Indeed, last September, a group of 60 nations, including France, Britain and Japan, propose at the U.N. summit on the Millennium Development Goals that a tax be introduced on international currency transactions to raise funds for development aid.

The proposed 0.005 percent tax on currency transactions would raise as much as $35 billion a year in development aid, claimed the proponents.

More Soros ties:

Greenberg, meanwhile, also runs his own polling and strategy firm, Greenberg Quinlan Rosner.

A partner in the firm is Jeremy D. Rosner, who was special assistant to Clinton during his first term in office, serving as counselor and senior director for legislative affairs on the staff of the National Security Council.

Rosner’s current client list, according to Greenberg’s website, includes Soros’ Open Society Institute.”

Source:

http://www.wnd.com/index.php?fa=PAGE.view&pageId=342905

Note: The following articles and/or blog posts and videos relate to this disturbing issue-You Decide:

What's wrong with this picture?

I. Union violence of little interest to media!

Posted on American Thinker-By K.E. Campbell-On September 9, 2011:

“Over 500 people “storm” private property, break windows and vandalize other property, wield baseball bats and crowbars, make death threats, and allegedly hold six guards hostage. Fifty law enforcement officers respond. U.S. Marshalls are placed on standby to enforce a related injunction issued by a federal judge.

It happened yesterday at a grain terminal at Port of Longview in southwest Washington State. The perpetrators? Members of the International Longshore and Warehouse Union (ILWU). The local police chief was quoted as saying, “A lot of the protesters were telling us this is only the start.”

Not surprisingly, the incident didn’t garner much national attention. Imagine how the coverage by the so-called mainstream media would have differed had anything even remotely similar occurred at a gathering of people of a different political persuasion, say those Tea Party SOBs.

Union violence is not rare. The National Institute for Labor Relations (NILR) has collected over 9,000 reports of union violence since 1975 and the actual number is much higher—by as much as a factor of ten. Only a fraction of such offenses result in arrest and conviction.

On Monday, Teamsters Union president James Hoffa proudly declared, “The one thing about working people is we like a good fight.” (Fight, not good, being the operative word.). Echoing Hoffa, ILWU President Bob McEllrath said “It shouldn’t be a crime to fight for good jobs in America.”

The fight crowd has certain federal legal precedent on its side of the ring. According to NILR, the U.S. Supreme Court’s 1973 Enmons decision, among other factors, makes prosecution of union violence difficult. According to the Cato Institute, violence “deemed to be in furtherance of “legitimate” union objectives” is exempt from prosecution under federal anti-extortion laws. Offenders can be charged and prosecuted under state and other federal laws, but the scales of “justice” in such instances, just like our federal government’s overall pro-union rather than union-neutral stance, are tipped in favor of organized labor. Until that changes, we’ll get more of the rot such laws and regulations have wrought.”

Source:

http://www.americanthinker.com/blog/2011/09/union_violence_of_little_interest_to_media.html

II. Left preparing street chaos, class warfare: ‘Radicals behind Seattle protests plan 'intimidation' at major NATO, G-8 summits’-Posted on WND.com-By Aaron Klein-On August 1, 2011:

http://www.wnd.com/?pageId=328817

III. Obama Mum on Details From Secret AFL-CIO Meeting!-Posted on The Daily Caller-By Matthew Boyle, The Daily Caller-On August 3, 2011:

IV. Linked: White House and 'urban terrorism': ‘Book documents president's dedication to organization set on collapsing America’-Posted on WND.com-On May 5, 2011:

http://www.wnd.com/index.php?fa=PAGE.view&pageId=295253

V. Will Soros Get His Wish? ‘See The Destruction of Capitalism and A New World Order!’-Posted on America’s Survival-By Cliff Kincaid-On May 10, 2010:

http://www.usasurvival.org/ck05.11.10.html

VI. Who’s Afraid of the Big Bad Soros?-Posted on Canada Free Press-By Joy Tiz-On February 3, 2010:

http://www.canadafreepress.com/index.php/article/19648

VII. Egyptian Officials: Outside Agitators Behind Riots!-Posted on Israel National News-By Elul-On September 11, 2011:

http://www.israelnationalnews.com/News/Flash.aspx/219974#.Tm0jnmA4i_0

VIII. Largest U.S. union behind Mideast riots?-Posted on WND.com-By Aaron Klein-On August 8, 2011:

http://www.wnd.com/index.php?fa=PAGE.view&pageId=331509

IX. Video: Socialist Explain How They Worked With Muslim Brotherhood In Egypt!-Posted on YouTube.com-By NakedEmperorNews1-On May 31, 2011:

https://www.youtube.com/watch?v=PdI0A1KLKmM&feature=related

Note: My following blog posts contain numerous articles and/or blog posts and videos that relate to this disturbing issue-You Decide:

Is President Obama in on the Uprising in Egypt?

http://weroinnm.wordpress.com/2011/02/01/is-president-obama-in-on-the-uprising-in-egypt/

Godfather of The Islamic Revolution!

http://weroinnm.wordpress.com/2011/02/11/godfather-of-the-islamic-revolution/

Is President Obama inciting riots across the US?

http://weroinnm.wordpress.com/2011/02/23/is-president-obama-inciting-riots-across-the-us/

Who owns our supposedly fair and balanced airwaves and news outlets?

The Midterm Elections and the Communist Manifesto!

http://weroinnm.wordpress.com/2010/10/08/the-midterm-elections-and-the-communist-manifesto/

Powerful men who meet secretly to plan on how to run our country!

http://weroinnm.wordpress.com/2010/06/28/powerful-men-who-meet-secretly-and-plan-on-how-to-run-our-country/Progressives and Communists Are Out of the Closet Together!

http://weroinnm.wordpress.com/2010/10/05/progressives-and-communists-are-out-of-the-closet-together/

Who is sponsoring the NAACP’s ‘One Nation Working Together’ rally?

Is it important to understand the Marxist assault on the foundations of our system?

Note: If you have a problem viewing any of the listed blog posts please copy web site and paste it on your browser. Be aware that some of the articles and/or blog posts or videos listed within the contents of the above blog post(s) may have been removed by this administration because they may have considered them to be too controversial. Sure seems like any subject matter that may shed some negative light on this administration is being censored-What happened to free speech?-You Decide.

“Food For Thought”

God Bless the U.S.A.!

https://www.youtube.com/watch?v=Q65KZIqay4E&feature=related

Semper Fi!

Jake

Sarah Palin inspired her typical extraordinary level of excitement and attendance at our Tea Party Express V national bus tour rally in Manchester, NH. I overheard a national reporter commenting to two of our staff members, “Yeah, Palin draws a crowd but they are all missing teeth.”

I was furious! I wanted to say, “How dare you? You arrogant jerk!” I held my tongue as a representative of Tea Party Express.

After attending over 200 tea parties on six national bus tours, I can assure you the majority of the attendees are extremely well informed, educated, articulate and patriotic Americans. They are not stupid rednecks as the reporter's comment implied. Unfortunately, the snobby reporter's view of the tea party is shared by the liberal Obama sycophant media.

At our Tea Party Express rally in Providence, RI, a former Marine and his adult son stood in the rain and wept along with others as I sang “God Bless the USA”. We embraced as brothers in our love for the greatest nation on the planet. Feeling the warmth which filled the air as I sang, I commented to the audience, “Does this feel like hate to you?”

And yet, the Congressional Black Caucus claimed these same Tea Party patriots desire to see me, a black man, “hung from a tree”.

So, the consensus of the left and liberal media is the Tea Party is white ignorant violent racists. Their strategic branding of the Tea Party is designed to justify the Obama administration's vitriolic language which include threats of violence.

Jimmy Hoffa referring to the Tea Party sent out his union thug clarion call to “take the sons of b***** out!” Decent hard working American Tea Party activists are now fearful for their lives.

My dad says while a snake can swim under water like a fish for a very long time, eventually it must come up for air because it is not a fish. It is a snake.

Obama pretends to be a president. But when pressured, the real Obama comes up for air revealing himself to be a community organizer; a rabble-rousing promoter of entitlements and class envy willfully dividing Americans along racial lines. Obama and his minions are evil.

We have seen Obama in numerous cowboy movies. Obama is the loud mouth guy standing on the steps of the jail-house yelling at the crowd. He works the crowd into a frenzy causing them to overrule the sheriff and the law, drag out the prisoner and hang him without a trial.

Since the beginning of his presidency, on numerous occasions, our community-organizer-in -chief has worked his minions into a frenzy to punish white police, banks, Wall Street, corporate CEOs, private jet owners, Arizonians, insurance companies, doctors, the rich, and anyone opposing Obamacare.

As testimony to the effectiveness of the Tea Party, Obama has instructed his minions, Congressional Black Caucus and unions to escalate their slander and level of vitriol which now includes threat of violence. The left has set aside September 17th as their National Day of Rage. Lord knows what evil they have scheduled. The left has created a violent hate-filled game titled, “Tea Party Zombies Must Die”. www.teapartyzombiesmustdie.com

Meanwhile, the liberal media appears tone deaf to the lies, hate, anger and violence coming from the left. When Obama instructed his minions to “push back twice as hard” against those who opposed Obamacare, black conservative Kenneth Gladney was beaten and sent to the emergency room by SEIU thugs. Clearly, Obama's new enforcers are misinformed flash mobs of black youths attacking whites across America.

And who does the liberal media promote as being ignorant, extreme and dangerous? The Tea Party.

Lloyd Marcus, Proud Unhyphenated American

Co-Chairman of The Campaign to Defeat Barack Obama.

Please help me spread my message by joining my Liberty Network.

Lloyd is singer/songwriter of the American Tea Party Anthem and author of Confessions of a Black Conservative, foreword by Michele Malkin

LloydMarcus.com

Posted on The Heritage Foundation-By Ericka Andersen-On September 11, 2011:

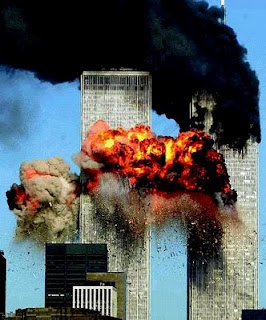

“Today, we join America in honoring the anniversary of September 11, 2001, when terrorists killed nearly 3,000 of our fellow citizens. In the days after 9/11, Americans stood together as one, setting aside partisan fervor and recognized a common enemy in Islamist terrorist groups, particularly al-Qaeda. National security was rightfully restored as our nation’s highest priority.

Ten years later, Osama bin Laden is dead, delivering to victims’ families and the rest of America a bit of justice for the heinous acts we all witnessed. But one terrorist’s death does not justify returning to the national security mindset that existed prior to that day.

As Thomas Paine said, “Those who expect to reap the blessings of freedom must, like men, undergo the fatigue of supporting it.”

That notion is ever true. Thanks to important policies put into place after 9/11, America has been able to thwart at least 41 publicly known terrorist attacks. Such vigilance saved lives and will continue to do so moving forth. As Heritage’s Matt Mayer wrote days after bin Laden’s death:

“In terrorist hideouts across the globe, many men with similarly warped views are eager to become the next bin Laden. They know the path to that title [lies] in successfully attacking us domestically and causing substantial death and destruction.”

The global war on terror that began as a result of 9/11 continues, and brave men and women risk their lives daily to protect America and prevent future acts of terrorism. As soldiers return from Afghanistan and Iraq after third or fourth tours of duty, we’re reminded that a clear and present danger remains.

Unfortunately, President Obama isn’t taking the threat seriously enough. The embattled debt ceiling policy outcome proved this, delivering a bitter pill of $500 billion in cuts to our national security.

Heritage’s Baker Spring writes of the policy:

…the policy established by the debt ceiling law will strip the military of its ability to secure the vital interests of the United States. The law, unless it is altered or repealed, will do irreparable harm to the United States military.

… History has repeatedly shown that these kinds of reductions in defense are penny wise and pound foolish, because they often serve to increase the likelihood of conflict. And weakness that invites war is much more expensive than deterring our enemies by maintaining an adequate defense budget all along.

Without the necessary security, America’s position as a world superpower will begin to decline. And still, President Obama and congressional liberals press on, putting our national security in jeopardy. Defense spending is far below its historical average, while money spent on unsustainable entitlement programs eats up two-thirds of the federal budget. America’s budgetary priorities are badly mismanaged, and our readiness suffers as a result.

Heritage’s Mackenzie Eaglen writes:

“No military service has been immune from wear and tear over 10 years of constant combat and other operations. According to General Marine Corps General Joseph Dunford, Jr., two-thirds of non-deployed Marines are not at acceptable readiness levels. This means they’re unable to respond to unforeseen crises if needed.”

America’s military requires the ability to respond forcefully and effectively, and it relies on Congress and the President to provide the necessary resources.

As Abraham Lincoln said in the Gettysburg Address, “It is for us the living, rather, to be dedicated here to the unfinished work which they who fought here have thus far so nobly advanced.”

On this, the 10-year anniversary of 9/11, it’s important to honor the victims and the heroes of that day by not only remaining on guard, but promising we will never quit this important fight until the threat no longer exists.

We ask Americans to join us in a display of unity once again. Today, we hope that every neighborhood across the nation is flooded with American flags celebrating the lives of those we lost in New York, Virginia and Pennsylvania and the heroism we witnessed, while also reminding each other that the fight to prevent another attack is not over.

Please visit The Foundry to read our special page Remembering 9/11: Never Quit, where we feature articles from special guests who have shared with us their thoughts on this day. On Twitter, send us pictures of your flag flying by using the hashtag #Flag911 in your tweet to offer your own remembrances and encourage others to join with us.

We must remember how we stood as a nation with a shared purpose and intensity on September 12, 2001, and in the days following. That collective and eternal vigilance is still essential. Never quit.”

Source:

Note: The following articles and/or blog posts and videos relate to this disturbing issue-You Decide:

I. Official Sept. 11 memorial called Obama 'whitewash': '10 years after the 9/11 attacks, you would think we lost the war'!

Posted on WND.com-By Bob Unruh-On September 7, 2011:

“The “official” memorial on Sunday for the nearly 3,000 victims of radical Islamists on Sept. 11, 2001, will be nothing more than a “whitewash” of the enemy trying to bring America down, so another event is planned, and at that one, the truth will be told, according to one organizer.

Pamela Geller, of Atlas Shrugs and a key leader in planning Sunday’s second annual Freedom Rally at 3 p.m. at Park Place and West Broadway, told WND today tens of thousands, including first responders and members of the clergy, are expected to be in attendance.

The focal point will not be obfuscated, either, by high-sounding calls to “service” and advocacy for “tolerance,” she warned.

“If we don’t understand who wants to destroy our country, our way of life and civilization, how can we possibly be able to defeat them,” she asked.

The event is being assembled by her American Freedom Defense Initiative, and its Stop Islamization of America Program, as well as Robert Spencer of Jihad Watch.

“We must show the jihadists we are unbowed in the defense of freedom,” she said.

Back when she was being taught about the Japanese attack on Pearl Harbor, an event that brought the U.S. into World War II and eventual victory over both the Japanese and German behemoths, she said, there wasn’t much discussion about either tolerance or service projects.

“I was taught about a resolve, a united America that by 10 years later had defeated the Japanese,” she said. “Ten years after [the 9/11 attacks] you would think we lost the war. We’ve adopted the Muslim narrative.”

The official memorial event in New York has been announced, but officials have confirmed it will not include members of the clergy and families of the first responders who died along with those they were trying to help were not invited, among other actions that leave an unwelcome flavor for those concerned about the U.S.

Geller told WND that one of the conclusions of the 9/11 commission assigned to review the attack found that a failure of “imagination” contributed to the success of the Muslim attackers.

“I posit that it’s a failure of information. What we’re clearly seeing is a whitewash of 9/11. ... Nine-eleven is not a day of ‘service.’ That’s just a way of distracting from the message, the mourning the remembrance,” she said.

She specifically cited Barack Obama, who said only days ago that “folks across the country – in all 50 states – will come together, in their communities and neighborhoods, to honor the victims of 9/11 and to reaffirm the strength of our nation with acts of service and charity.”

He noted, “In Minneapolis, volunteers will help restore a community center. In Winston-Salem, N.C., they’ll hammer shingles and lay floors to give families a new home. In Tallahassee, Fla., they’ll assemble care packages for our troops overseas and their families here at home. In Orange County, Calif., they’ll renovate homes for our veterans.

“There are so many ways to get involved, and every American can do something. To learn more about the opportunities where you live, just go online,” he said.

That message, however, is a disservice to the nation and a distraction from the real point: that Muslim radicals attacked the U.S. and the same agenda is driving nations even today to create problems for America, Geller said.

“There is an enemy who is very much at war with us. We’re in Afghanistan and Iraq, and the president never articulates why,” she said.

“I’m deeply disturbed. ... This is part of the stealth jihad, the whitewashing of Islamic jihad,” she said.

The issue is that the nation, and its centers of power, were targeted – the Pentagon for the military, New York for the financial interests and either the Capitol or the White House (apparently targeted by Flight 93 that went down in Pennsylvania) for the political system. All were in the bull’s-eye of radical Islamists and such an attack needs an appropriate response, she said.

“The crew and passengers on Flight 93 ... that was the first American response [to the attacks],” she said. “A group of regular, average Americans wrestled control of the airplane. They took that plane and took it down.”

Now, she said, “People need to know there will be patriots standing at Ground Zero.”

Additional focal points will be to try to halt a project that has plans to put a mosque on the scene of one of the attacks during 9/11, as well as on an “anti-Semitic” Durban conference in the United Nations, she said.

Speakers at the really will include Alexander and Maureen Santora, who lost their son Christopher; Sally Regenhard, whose son was killed, and Nelly Braginsky, whose son Alexander died, among many others.

https://www.youtube.com/watch?v=T1wOq8WPs6E&feature=player_embedded

In a WND column by Jim Fletcher, Geller explained that the circumstance of denying culpability and using soft-sounding words to describe a brutal and bloody terror attack is one step toward the Islamization of the U.S.

“Under Shariah [Muslim religious law}, you cannot insult Islam, you cannot criticize Islam, you cannot defame Islam. And so this is what you witness with the media: I mean, they will not criticize Islam or offend Islam. Now, they have no problem offending Christianity or Judaism, so whether they are aware that they are being Shariah-complaint or not, they are!”

She also reveals in her new book, “Stop the Islamization of America: A Practical Guide to the Resistance,” the Justice Department alone has some 14,100 documents – not just pages but entire documents – that pertain to government “outreach” to Muslims.

“This is astounding. I made a fairly narrow request, narrowed down to specific groups and carefully defined activity that the Civil Rights Division doesn’t even have direct jurisdiction over – ‘Muslim Outreach’ – and they come up with 14,100 matching documents. A knowledgeable Justice Department insider told me: ‘You couldn’t generate 14,000 pages of documents if you asked for communications with lenders or apartment or hotels as part of the Housing Section enforcement activities. There are very few things in Civil Rights that would generate 14,000 pages of anything. It has got to be a treasure trove of information,’” she wrote.

It was the office of New York City Mayor Michael Bloomberg that confirmed there will be no clergy allowed at the city’s Sunday observance of the 10th anniversary of the slaughter of innocent victims.

Presidential candidate Rick Santorum said the precedent was “disconcerting.”

“It is important to allow clergy to attend and take part in the memorial intended to bind the wounds of a still healing nation,” he told The New American.

The decision also drew a sharply negative reaction from members of the evangelical community.”

Source:

http://www.wnd.com/index.php?fa=PAGE.view&pageId=342493

II. How to Defend America in the 21st Century! (Part 1)-Posted on Floyd Reports-By Guest Writer-On August 5, 2011:

http://floydreports.com/how-to-defend-america-in-the-21st-century-part-1/

III. How to Defend America in the 21st Century! (Part 2)-Posted on Floyd Reports-By Guest Writer-On August 12, 2011:

http://floydreports.com/how-to-defend-america-in-the-21st-century-part-2/

IV. No Justice, No Peace on 9/11 Anniversary!-Posted on NewsMax.com- By Bradley A. Blakeman-On September 11, 2011:

http://www.newsmax.com/Remember911/Remembering-9-11-attacks/2011/09/11/id/410486

V. Guess who thinks they are the victims?-Posted on WND.com-By Michael Carl-On September 10, 2011:

http://www.wnd.com/?pageId=343685

VI. Islam, Appeasement, and Western Suicide!-Posted on CultureWatch-By Bill Muehlenberg-On September 3, 2011:

http://www.billmuehlenberg.com/2011/09/03/islam-appeasement-and-western-suicide/

VII. The Administration Takes on ‘Islamophobia’: ‘The White House is giving free-speech opponents a megaphone’-Posted on National Review Online-By NINA SHEA-On September 1, 2011:

http://www.nationalreview.com/articles/276021/administration-takes-islamophobia-nina-shea?page=1

VIII. Islamic Supremacism Trumps Christianity at Ground Zero!-Posted on American Thinker-By Pamela Geller-On July 22, 2011:

http://www.americanthinker.com/2011/07/islamic_supremacism_trumps_christianity_at_ground_zero.html

IX. Video: Herman Cain’s 9/11 Tribute Drives Liberals Crazy (Well,Crazier)!-Posted on ExposeObama.com-By Ben Johnson,The White House Watch-On September 11, 2011:

Note: May God Bless & Keep All Our Brave & Courageous Heroes & Their Families. May We Never Forget Those That Have Made The Ultimate Sacrifice & Those That Continue To Keep Us Free. God Bless Them & God Bless America!

Video: Amazing Grace – Remembrance!

https://www.youtube.com/watch?feature=player_embedded&v=mN5praoZnQ0

Note: My following blog post contains numerous articles and/or blog posts and videos that relate to this disturbing issue-You Decide:

Spitting in the Face of Everyone Murdered on 9/11!

http://weroinnm.wordpress.com/2010/05/10/spitting-in-the-face-of-everyone-murdered-on-911/

The Military Pays the Price for Obama’s Agenda!

http://weroinnm.wordpress.com/2010/08/11/the-military-pays-the-price-for-obama’s-agenda/

Godfather of The Islamic Revolution!

http://weroinnm.wordpress.com/2011/02/11/godfather-of-the-islamic-revolution/

Should Americans Fear Islam?

http://weroinnm.wordpress.com/2010/10/05/should-americans-fear-islam/

Do Muslims need to look in the mirror?

http://weroinnm.wordpress.com/2011/01/04/do-muslims-need-to-look-in-the-mirror/Could Steps That Team Obama Has Taken Be Emboldening Terrorists?

Note: If you have a problem viewing any of the listed blog posts please copy web site and paste it on your browser. Be aware that some of the articles and/or blog posts or videos listed within the contents of the above blog post(s) may have been removed by this administration because they may have considered them to be too controversial. Sure seems like any subject matter that may shed some negative light on this administration is being censored-What happened to free speech?-You Decide.

“Food For Thought”

God Bless the U.S.A.!

https://www.youtube.com/watch?v=Q65KZIqay4E&feature=related

Semper Fi!

Jake

John Ernst "Jack" Eichler

He gave his life on September 11th 2001 in the Twin Towers. Jack shall always be remembered by the Eichler family.

Please keep America in your prayers.

In the middle of the 911 memorial service, NBC's Brian Williams uses the occasion to proclaim that we had no business going into Iraq... Shameless!!!

Whether you are radical, moderate or somewhere above , below or in between. If you are of the muslim faith you follow the koran and its' teaching, RIGHT? A book inspired by satan which promotes violence, rape, lying, murder and mayhem. How can you be associated with this and call yourself peaceloving? We are ONE AND ONLY ONE NATION UNDER GOD! We are a nation built upon Judean and christian principles. We have two God inspired writings that ( when followed ) has and will keep our nation great. Those writings are the HOLY BIBLE and our UNITED STATES CONSTITUTION. Evil is attacking our country , not only from outside but from the inside also. Those who would want our freedom abolished, our God given rights done away with, yes our entire way of life changed to something in line with sharia law are here. Liberals may call themselves patriotic but your agenda is like rust, it eats slowly away at the things true Americans hold dear. Progressives are the same. Freedom of religion should be tightly embraced but when this "religion" encourages murder, lying, deceit, rape, destruction, elitism, degradation of women and children and everything that destroys freedom. This is not a religion but evil incarnate. I watch God and our freedom being pushed out of the picture. This coming year, please let us replace the administrative garbage that is destroying this nation. Research who you are voting for. Look at who and what they align themselves with. Look at their demeanor, the way they interact with people. You get my drift. Always follow that gut feeling. May God bless and keep us from what is coming.

God bless with His grace and mercy all those who lost their lives on 9/11 at the hands of Satan. I pray they are at peace with our Saviour. Also, God bless all those who died before and after under the same circumstances.

Posted on CultureWatch-By Bill Muehlenberg-On September 3, 2011:

“Back in June 2009 President Obama gave a speech in Cairo. In it he said, “I consider it part of my responsibility as President of the United States to fight against negative stereotypes of Islam whenever they appear.” Sorry Barack Hussein Obama, but the only real duty of the President of the United Sates is to uphold the Constitution and defend that nation against any threats.

It is not the duty of the President to appease America’s enemies, or seek to rewrite history, or push ideological agendas. And it certainly is not the duty of the US President to become an apologist for Islam. I don’t recall in his swearing-in ceremony any words about him becoming the first President in American history to champion the cause of Islam.

Indeed, imagine if he dared to say, “I consider it part of my responsibility as President of the United States to fight against negative stereotypes of Christianity whenever they appear.” The entire secular leftist world would go apoplectic: “Hey, what the heck happened to that separation of church and state?” They would be going ballistic over such a statement.

But the promotion and defence of Islam seems to be just hunky-dory. We have seen Obama engage in one anti-Christian agenda item after another, while at the same time bending over backwards to appease Islam. But of course he is not alone in this.

Plenty of American leaders have become de facto apologists for Islam, all the while denigrating their own country and its Judeo-Christian heritage. This in itself is bad enough, but when it compromises American security, it becomes even worse.

So fearful are so many American elites of offending Muslims in any way, that they have completely lost the plot, and fail to face reality. They simply do not want to get real about who our enemies are. And the last time I checked, it was not old, grey-haired, white women taking lessons in how to fly low-level swoops on 747s.

Mark Steyn in his very important new book also speaks to this insanity of failing to identify who our enemies are. He too worries greatly about how we are putting American security at jeopardy because of moronic political correctness and anti-anti-Islamism. Says Steyn:

“The lessons of 9/11 were quickly buried under a mountain of relativist mush. Consider the now routine phenomenon by which any, um, unusual event is instantly ascribed to anyone other than the obvious suspects. When a huge car bomb came near to killing hundreds in Times Square, the first reaction of Michael Bloomberg, New York’s mayor, was to announce that the most likely culprit was ‘someone with a political agenda who doesn’t like the health care bill’ (that would be me, if his SWAT team’s at a loose end this weekend). When, inevitably, a young man called Faisal Shahzad was arrested a couple days later, Mayor Bloomberg’s next reaction was to hector his subjects that under no circumstances would the city tolerate ‘any bias or backlash against Pakistani or Muslim New Yorkers’.”

But let’s get back to Obama. His relentless attempts at placating, appeasing and promoting the Islamic cause is as foolish as it is dangerous. Consider one damaging piece of UN moonbattery, the United Nations Human Rights Resolution 2005/3, “Combating Defamation of Religions,” which was passed in April of 2005.

This resolution stated that “defamation” and criticism of Islam was simply out of bounds. Amazingly, the non-binding resolution was easily passed. It was presented to the UN by Pakistan, on behalf of the Organisation of the Islamic Conference (OIC).

Hot on the heels of this is Resolution 16/18, also moved by OIC (which now stands for the Organization of Islamic Cooperation). Nina Shea picks up the story, alerting us to this alarming situation: “The White House is giving free-speech opponents a megaphone”.

Says Shea: “Last March, U.S. diplomats maneuvered the adoption of Resolution 16/18 within the U.N. Human Rights Council (HRC). Non-binding, this resolution, inter alia, expresses concern about religious ‘stereotyping’ and ‘negative profiling’ but does not limit free speech. It was intended to — and did — replace the OIC’s decidedly dangerous resolution against ‘defamation of religions,’ which protected religious institutions instead of individual freedoms. But thanks to a puzzling U.S. diplomatic initiative that was unveiled in July, Resolution 16/18 is poised to become a springboard for a greatly reinvigorated international effort to criminalize speech against Islam, the very thing it was designed to quash.”

She continues, “Having won the latest round in the ideological contest for individual rights and freedoms at the United Nations this past March, the administration is now gratuitously establishing a new ‘transnational’ forum to essentially re-litigate the matter with a body that is openly hostile to such freedoms. This forum’s agenda is to be structured so that freedom of expression will be put on trial and inevitably condemned by most forum participants as, itself, a human-rights violation. In raising OIC expectations that ‘anti-Islam and anti-Muslim attitudes’ will be dealt with under soon-to-be-drafted ‘implementation’ procedures, the administration is riding a tiger.”

Australian religious freedom expert Elizabeth Kendal has also written extensively on this worrying development. She very nicely summarises what this move is all about:

“And so, while it is being hailed in the West as a victory for free speech, Resolution 16/18, ‘Combating intolerance …,’ is even more dangerous than resolution 2005/3, ‘Combating Defamation of Religion’. It is in no way an OIC back-down or a breakthrough for liberty. Rather, the change in focus from defamation to incitement is not only totally consistent with OIC strategy since early 2009, but it actually advances the OIC’s primary goal: the criminalisation of criticism of Islam.”

Let me repeat this last line; this is all about “the criminalisation of criticism of Islam.” All over the Western world moves are under foot to make it a crime to say anything critical or negative about Islam. Here in Victoria we have Stalinist Religious Vilification laws which already basically operate in this fashion.

And concurrent with this is another major development all over the Western world: the move to make the proclamation of Christianity illegal. Laws are being passed all over the place with the sole purpose of silencing Christians. Whether they are vilification laws, or anti-discrimination laws, or so-called hate speech laws, the results are the same: a full-fledged attack on Christian freedom of speech.

It is interesting how these two dangerous trends so nicely dovetail: silence Christians, and silence any criticism of Islam. With laws like these being passed all over the West, who needs suicide bombers. Stealth jihad and creeping sharia are moving along quite nicely, thanks.

Of course getting laws like this passed will not result in the faithful getting their dark-eyed virgins in paradise, as dying for Allah does, but it still renders the West impotent, impoverished and enslaved. That too is something all Islamists look forward to.”

Source:

http://www.billmuehlenberg.com/2011/09/03/islam-appeasement-and-western-suicide/

Note: The following articles and/or blog posts relate to this disturbing issue-You Decide:

I. The Administration Takes on ‘Islamophobia’: ‘The White House is giving free-speech opponents a megaphone’-Posted on National Review Online-By NINA SHEA-On September 1, 2011:

http://www.nationalreview.com/articles/276021/administration-takes-islamophobia-nina-shea?page=1

II. Religious Liberty Monitoring: HR Resolution 16/18: ‘The OIC, the UN and Apostaphobia’-Posted on ElizabethKendal.blogpost.com-By Elizabeth Kendal-On August 21, 2011:

http://elizabethkendal.blogspot.com/2011/08/hr-resolution-1618.html

III. Christianity, Other Religions, Islam and Terrorism!-Posted on CultureWatch-By Bill Muehlenberg-On August 1, 2010:

http://www.billmuehlenberg.com/2010/08/01/christianity-other-religions-and-islam/

IV. Obama Nation's Low View of Christianity!-Posted on Townhall-By Robert Knight-On June 8, 2009:

http://townhall.com/columnists/robertknight/2009/06/08/obama_nations_low_view_of_christianity

V. Barack Obama extends his hand to Islam's despots: ‘The American President may not know it, but his 'Muslim world' is split by a war of ideas’-Posted on The Telegraph-By Amir Taheri-On June 6, 2009:

VI. Obama, Islam and Appeasement!-Posted on CultureWatch-By Bill Muehlenberg-On June 5, 2009:

http://www.billmuehlenberg.com/2009/06/05/obama-islam-and-appeasement/

VII. Apologies and Ayatollahs!-Posted Townhall-By Oliver North-On June 5, 2009:

http://townhall.com/columnists/olivernorth/2009/06/05/apologies_and_ayatollahs

VIII. The Prism of Obama!-Posted Townhall-By Jonah Goldberg-On June 5, 2009:

http://townhall.com/columnists/jonahgoldberg/2009/06/05/the_prism_of_obama

IX. Platitudes and naivete: Obama's Cairo speech!-Posted on Jihad Watch-By Robert-On June 4, 2009:

http://www.jihadwatch.org/2009/06/platitudes-and-naivete-obamas-cairo-speech.html

X. DOJ in bed with Islamic supremacist groups!-Posted on WND.com-By Pamela Geller-On September 6, 2011:

http://www.wnd.com/index.php?fa=PAGE.view&pageId=342081

XI. Obama: 'Islam Has Always Been Part of Our American Family!”- Posted on Politico-By POLITICO STAFF-On Agusut 11, 2011:

XII. FBI Has Mixed Views of Obama Administration!-Posted on NewsMax.com-By Ronald Kessler-On August 10, 2011:

http://www.newsmax.com/RonaldKessler/fbi-Khalid-Sheikh-Mohammed/2011/08/10/id/406824

XIII. Obama Issues Statement Marking Ramadan, But No Easter Statement This Year!-Posted on CNSNews.com-By Penny Starr-On August 2, 2011:

http://www.cnsnews.com/news/article/obama-issues-statement-marking-ramadan-n

XIV. Stop Obama’s Attack on Christianity!-Posted on The Patriot Update-By Michael Reagan-On July 16, 2011:

http://patriotupdate.com/articles/stop-obamas-attack-on-christianity

XV. Obama Wants to Cut God Out of Government!-Posted on Floyd Reports-By Guest Writer-On July 6, 2011:

http://floydreports.com/obama-wants-to-cut-god-out-of-government/

XVI. Gallup: Muslim Americans Give Obama 80 Percent Approval, Highest of Major Religions!-Posted on CNSNews.com-By Terence P. Jeffrey-On August 10, 2011:

http://www.cnsnews.com/news/article/muslim-americans-give-obama-80-percent-a

XVII. Turning On Israel!-Posted on CultureWatch-By Bill Muehlenberg-On May 24, 2011:

http://www.billmuehlenberg.com/2011/05/24/turning-on-israel/

XVIII. Islamic Sharia Law Proliferates in Germany!-Posted on Hudson New York-By Soeren Kern-On September 8, 2011:

http://www.hudson-ny.org/2397/islamic-sharia-law-germany

Note: My following blog post contains numerous articles and/or blog posts and videos that relate to this disturbing issue-You Decide:

Should Americans Fear Islam?

http://weroinnm.wordpress.com/2010/10/05/should-americans-fear-islam/

Godfather of The Islamic Revolution!

http://weroinnm.wordpress.com/2011/02/11/godfather-of-the-islamic-revolution/

The Islamic Infiltration: Inside Our Government, Armed With Our Secrets!

Is Obama Administration "Abandoning" Israel?

http://weroinnm.wordpress.com/2010/01/14/is-obama-administration-abandoning-israel/

Faith of Our Forefathers!

http://weroinnm.wordpress.com/2010/05/09/faith-of-our-forefathers/

Europe's Looming Demise: Changes on the Continent Cloud Our Future!

Note: If you have a problem viewing any of the listed blog posts please copy web site and paste it on your browser. Be aware that some of the articles and/or blog posts or videos listed within the contents of the above blog post(s) may have been removed by this administration because they may have considered them to be too controversial. Sure seems like any subject matter that may shed some negative light on this administration is being censored-What happened to free speech?-You Decide.

“Food For Thought”

God Bless the U.S.A.!

https://www.youtube.com/watch?v=Q65KZIqay4E&feature=related

Semper Fi!

Jake

One of the most challenging duties I have as an American citizen is to sit through a Barak Obama speech. But do my duty, I will, and I did so last Thursday evening. Sort of. First of all, the conventional wisdom that Obama is eloquent is false. He is not eloquent, he is not a master of communication, he is not as intelligent as we are told to believe. But he is clever, and he has a snake-pit of clever advisors behind him. Obama’s September 8 speech is simply a political set up for him to run against a “do-nothing” Congress in 2012. Clever, yes. More clever than the American people? No.

The content of Thursday’s speech was a rehash of former “stimulus” speeches. His “American Jobs Bill” is just another infusion of tax-payer dollars into the ether of his command economy. If he has his way another $400 billion will waft into the netherworld of socialist failure, just like the previous $3.27 trillion from previous stimulus packages. There is nothing in his AJB that would create a single lasting job. It is an attempt to pander to large swaths of his supporters, like teachers unions, government sector unions, the Teamsters and the AFL-CIO, who would all benefit directly or indirectly from his plan.

Obama pandered to small businesses as well with talk about a “payroll tax cut.” But it is corporate taxes, capital gains taxes, and personal income taxes on the small business owners who make over $200 K per year and declare their business income on their personal returns, that are killing jobs. Obama did not address those, but instead promised again to raise taxes on “those Americans who can afford to pay more.” In his mind that includes all of those small businesses and their owners who we know are not “millionaires and billionaires” but are ordinary Americans, struggling, cutting corners, pinching pennies, and fighting the federal government at every turn just to save the jobs they have created for their employees. As usual, Obama’s plan will kill more private sector jobs in exchange for a small rebate to households that will go to pay down debt and will have no lasting impact on the economy. He will fortify the unions, they will grow in power, and in the end, the government will be bigger, and the individual much smaller. Corporations will continue to outsource to other countries because the costs of production are impossibly large. And small businesses will continue to shutter their doors as the specter of Obamacare looms ever closer.

One of the most ironic aspects of Obama’s duplicity is his avoidance of the most obvious and immediate answers to our failing economy. As a resident of Western Colorado I know that in my region of this vast country, there lies underground enough natural gas and oil resources to fuel our nation and our economy for decades, if not centuries. Obama’s pet agencies like the EPA and DOE have essentially corked the potential for energy exploration and development in the West. If he were to ease the regulations, tell Interior Secretary Ken Salazar to take a long vacation to Fiji, and simply open the door for Americans to take advantage of the vast energy resources underneath our feet, the economy would receive the defibrillation it needs to get pumping again. Thousands of private sector jobs would be created, and dependence on foreign energy would be dramatically decreased.

The American people will not fall for the “run against a do-nothing congress” ploy. The president can’t stay disengaged and ineffective for another 15 months. The economy cannot bear the strain of further taxation, regulation, and statist manipulations of the free market. If Obama was sincere he would do the following.

But we know Obama is not serious about saving our economy or our standing of economic and military superiority. He will continue to point the finger of blame, play the race card, and toy with the free markets of the greatest country the world has ever known, until he begins the longest vacation of his life in 2013.

Heisenberg’s uncertainty principle, published in September 1925, which happened to be in the month and year of my birth, Heisenberg, Hitler’s atom bomb builder, the Allies bombed his plant to the ground leaving the United States to be first with the atom bomb, because the United States was first freedom loving people won World War II.

I was on the high seas heading for the invasion of Japan’s main island when the war ended. How much is my one life worth? Is the good of all not worth more? Yes, but who is to know the good of all? The religious give God, in his wisdom, the right to do anything. We don’t question. We have the insane notion that we have the right, in God’s name, to obliterate mankind. This has direct relationship with Heisenberg’s uncertainty principle, which deals with the physical universe.

The time of my birth is related to a quantum leap in understanding the physical universe. According to Astrologer’s Handbook, since when I was born Saturn was trine Pluto, and trines mean harmonious interaction between the conscious expressions of these folks and their power potentials, and Saturn is the learning planet, Pluto the generational planet, this trine means I would have the ability to understand the laws by which subtle forces are organized, enabling me to use these laws constructively for myself and others. This realization came to me after I studied the Constitution.

The odd thing about my study of the Constitution is that I felt that voices from the past were personally speaking to me. I had a cause. I was determined to beat Uncle Sam at his own game; in other words, learn my constitutional rights and act. From the time that I studied the Constitution and acted, things went right for me. Freedom loving people won World War II. We Americans have lost sight of the power that lies within us.

Human existence is inconsequential until we are able to distinguish the quantitative from the qualitative. This brings to mind the destruction of the World Trade Center and loss of thousands of lives, something for freedom loving people to think about as we memorialize the tenth anniversary of 9-11.

The cutting edge of science has reached the conclusion that qualitatively the universe boils down to permanent and unchanging information. Mankind is the only life on the planet that can use this information to bring about, as well as atom bombs, technological wonders. Surely, man’s ultimate purpose is not to destroy himself. Heisenberg’s uncertainty principle brought into play choice in the everlasting beginning and end universe—the choice of greatness or self-annihilation. Don’t listen to the orthodoxy. The orthodoxy’s purpose is to enslave you. The Constitution tells us to look within and be empowered. It worked for me. It can work for you.